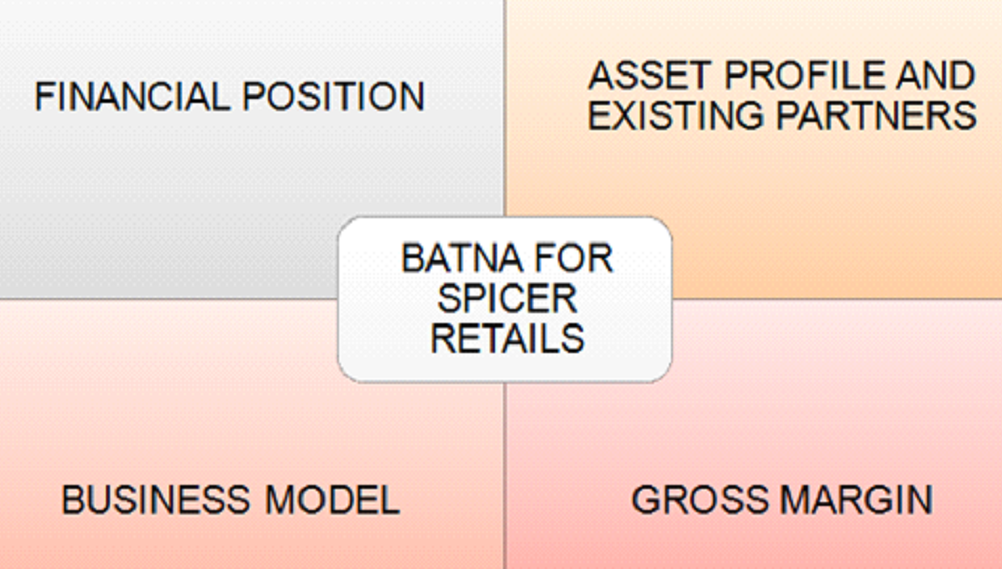

Q1. Identification and Description of BATNA

(Source: Self-made)

BATNA is stated as Best Alternative To a Negotiated Agreement. Negotiations are made on the basis of BATNA agreements when initial agreements with a party are unsuccessful (CFI, 2021). BATNA for Spicer retails revolves around its existing partners, asset profile of its stores, positioning, business model, and gross financial margin. Spicer retail is operated by APG Group that generates over 3.4 billion of revenue from its business interests. This company's business model comprises 120 retail stores, which includes 37 hypermarkets in more than 35 cities in India. Convenience stores and hypermarkets are major sources of income for this company. Negotiations are based on this company's categorized products and gross margin %. Other than fruits and vegetables, every product of this company recorded a gross margin % above 20%.

In addition, oil prices of this retail outlet kept on fluctuating daily. Under this fluctuation, this company has followed a markdown approach based on pricing. Effective measures based on pricing strategy and sales strategy on BATNA enhance a company’s value on market share (Karlsen, 2018). The process of BATNA has helped in upscaling its performance in the market. This retail market focuses on its consumer base and comprises well-trained staff. SR Company’s only partner Agritech has a good partnership. This helps in doubling their trade in terms of value and volume. This makes the Spicer Retail BATNA agreeable with other companies as it states every possible positive business outcome.

Q2. Approach of negotiation

BATNA can be defined as the best advantageous approach that a negotiating party can choose if negotiations fail and an agreement cannot be reached to a conclusion. It is used in tactics of negotiation and has always been considered before a negotiation takes place. It is never recommended to involve in a serious negotiation without knowing your BATNA. It is important as it provides an alternative if there are conflicts in the negotiation. It also provides the power of negotiation, and it determines the point of reservation by the worst price that is willing to accept (CFI, 2021).

(Source: Influenced by case scenario)

Observing the case scenario, the negotiation approach taken by Spicer consists of five styles: competing, avoiding, accommodating, compromising, and collaborating. As opined by Abramson (2020), these styles help in a correlation as well in the negotiation, especially when there is a tension between two or more groups and these styles try to meet their needs of conflict. Negotiators are assertive in these styles, which are also focussed and self-confident that deal. The individuals involved in these negotiations tend to be persuasive and voice their concerns to the other party, which is sometimes aggressive and domineering in demeanour. Agritech and Spice retailer have been in agreement in relation to fixing a price/MRP in a given year, and Agritech has an approach through which they offer a margin of a specific percentage that would promote and support Spicer retail. Keya (2021) opined that comparing assertive with cooperative, the assertive style in A competition is more useful than cooperative and cooperative is lower.

The negotiators who use the style of avoiding generally have assertiveness and apprehensiveness. The approach prefers avoidance that would reduce tension. The people involved need to stay neutral, removed or objective from a situation or transfer their responsibility to their counterparts. Immediately the individual does not pursue their own interest, and the element of self-sacrifice is included in this style. The approach of accommodation for this negotiation focuses on the maintenance of relationships with other parties. As opined by García et al. (2020), negotiators go for smoothening of detail tensions, differences to be minimized and concerned with the maintenance of good support for the satisfaction of their needs. Accommodating style is higher in cooperativeness and lower in assertiveness that tends to support the negotiator, and their relationship is taken as more important than agreement. The compromising attitude of negotiators has existed in this style that splits the concession of exchange, difference, and finding the solution of a quick middle ground. This tends to the satisfaction for both parties. This style focuses on the creation of a decent agreement that is relatively efficient while maintaining a relationship.

At last, collaborating with negotiators often comes under the style of communicative and honest directions. It focuses on finding novel solutions that are concerned with the satisfaction of both parties. It tends to take time to create long-term outcomes that have to be optimal. Spice retailer has to set their tactics by having a clear sense of aim with an alternative agreement. Commitment tactics have been given to Spicer retail if the hands of the opponent party are tied, and Spicer Retail has only discretion that is limited to negotiate with the owner.

Q3. Concept of expanding the PIE

Negotiations in a company are direct, complex, or collaborative. In the modern business world, companies are advised to utilize collaborative negotiations that ultimately develop relationships with existing partners of business (Baker, 2018). The process of growing or expanding the pie is referred to as a win-win situation, which is also termed collaborative negotiations. In this type of negotiation, every party works to maintain and develop a long-term and cooperative relationship where the party gains mutual satisfaction from their returns. Agritech, which has been a reliable supplier for spice retail, maintained its status of delivering flagship products of oil to its parent company. In relation to a case study, it has been noted that Agritech also deals in sales for soybean and mustard oil with brand names such as Subham and Nutriful.

In addition, this company deals in the sales of confectionaries and baked products. For expansion, Agritech is allowed to focus on selling a merchandised items or raw materials for a general increment in sales to its parent company. Prices of raw materials are increasing every day (Gunasekaran, 2021). The cotton market and its prices are touching roofs in terms of price and sales. For all products under the oil category, the gross margin is fixed at 7.65%, with a markdown on the MRP of products. The receipts and payments of data related to stocks are required to be cleared immediately by Spicer to Agritech.

Deals are fixed on the basis of regional level to determine trade negotiations for both of these companies on a national level. This has satisfied both parties that help to upscale its sales in terms of value and volume. This upscaling of sales enhances and motivates a business enterprise to perform better in a financial year. Gera et al. (2017) opined that quality of service allows a company to differentiate from its existing competitors inside a market. In addition, it increases its market shares, improves its relations with existing and new customers, and helps in enhancing corporate image. These factors result in reducing this company’s turnover rates.

Turnover rates are important as employees and workers are a major asset in driving a company's performance based on sales and profits (Greenberg, 2020). A reduction in this turnover rate is going to determine Spicer Retail and Agritech national-level deals at a regional level. After mutually agreeing to respective norms and conditions, there is going to be a notable change in the growth of the pie. A basic trade agreement between the parent and the sub-parent company is required to state clearly both company's role and holding of shares. By following the collaborative method of negotiation, problems decrease gradually related to shares and holding.

Q4. Targets that Spicer Retail

The targets given by Spice retailers as per observation are to achieve the schemes of incentives from Agritech and support the promotional system in all the places of their new products and existing products. In relation to the case scenario, it has been observed that the merchandise team of spice retail has been undergoing tremendous pressure for the consolidation of vendors that are based nationally. The top management has directed top management to move towards national negotiators for all their top 20% vendors.

The target of Spice retailer has been to increase visibility for the next 3-4 years, as decided at the annual Top Management retreat at the beginning of 2019. The merchandising team of Spice retailer has a visibility target of INR 100 million per year. The negotiation of Spice Retailer has been realistic as it has been mentioned that 56 vendors have been identified nationally that have carried all categories of products to a national level by making a deal. The spice retailer has been moving towards an efficient and organized way to carry out retail business. Spicer Retail agreed with Agritech according to margin percentage of markdown that has been noted is 7.65%. The margin of realization by spice retailers is 6.5% on the products of Agri tech due to promotions that are only done internally. Spicer Retail’s top management has been convinced that the promotion of products is the primary responsibility of vendors.

The aspects of being realistic depend on analysis and cultivation of BATNA: willingness and ability to talk is the best power source to walk away from starting another deal. Before arriving at the bargaining table, negotiators should be wise enough to identify the best alternatives for an agreement to be negotiated. The negotiators have to take important steps of BATNA to improve it. Realistically it is also identified by the process of negotiation and discussion of procedural issues to clear the problems that have been arising (Shonk, 2020). Research shows that building rapport is also realistic and produces real benefits. They are searching for smart trade-offs for distributive negotiation, making demands and concessions in a single issue.

The right strategy helps reduce the scope of cancellation of the deal, and often the problem arises with most high-stakes negotiations. Device makers have defined a strategy for narrowing the scope of deals with distributors that are incumbent for the negotiations to move forward. The expertise only lies with the owner and management team for achieving their targets. Dealmakers often conflate powers of negotiation with a strong BATNA and the concomitant's ability to hurt another party (Ertel, 2020). The solution is to think beyond alternatives in relation to walking away from a deal and often considers positive leverage from multiple sources. BATNA is a strong asset for negotiation as it is not affected by any external parties. Positive leverages mean that negotiators are offering to make the desired deal. It has been assumed that agreement in management retreat is possible through price promotions that need funding from vendors. Thus, the assets profile for this company has been expertly achieved as they have reached a negotiable deal with Agritech.